Employee vs. Independent Contractor Status

Be Very Careful

Introduction

Definitions:

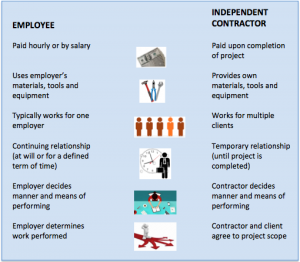

- An employee is a person who is hired for a wage, salary, fee or payment to perform work for an employer. Generally, the employer must withhold income taxes, withhold and pay Social Security and Medicare taxes, and pay unemployment tax on wages paid to an employee. The first step is to have the contractor complete IRS Form W-4.

- An independent contractor is a person who contracts to do work for another person according to his or her own processes and methods; the contractor is not subject to another’s control except for what is specified in a mutually binding agreement for a specific job.a person or business which performs services for another person or entity under a contract between them, with the terms spelled out such as duties, pay, the amount and type of work and other matters. An independent contractor is distinguished from an employee, who works regularly for an employer. An independent contractor must be able to determine when and where work is performed, be able to work for others, provide own equipment and other factors which are indicative of true independence. [1] The first step is to have the contractor complete IRS Form W-9.

[1] The People’s Law Dictionary by Gerald and Kathleen Hill ![]() Publisher Fine Communications

Publisher Fine Communications

Advantages:

Professional people such as dentists, hygienists, physicians, chiropractors, veterinarians and business owners who either own their businesses or whose services are for hire are often faced with questions relating to independent contractorship. It has come to my attention over the past 30 years that employers, employees and individual contractors often have a huge misconception of the Federal government’s view of individual contractors in the employment marketplace. Due to recent increased activity by the IRS, it is now more important than ever that business owners and their workers understand the government’s position. However, the question as to whether individuals are employees or independent contractors depends on the facts in each case. The general rule is that an individual is an independent contractor if the business owner, the person for whom services are performed, has the right to control or direct only the result of the work and not the means and methods of accomplishing the result.[2]

[2] IRS, Publication 15-A (2017), Employer’s Supplemental Tax Guide

Associates often prefer to be reclassified as independent contractors because the associates can fully offset benefits against income and receive a higher rate of compensation (at least that’s the conception that the independent contractor hopes the employer will do for them) that as an employee since the employer has eliminated payroll taxes and benefit costs.[3]

Employers have achieved their objective of reducing labor costs (direct wages and employee benefits) by either hiring workers as independent contractors or terminating existing employees and rehiring them as independent contractors. An advantage of labeling a worker as an independent contractor is that it lowers an employer’s tax obligation, since the employer does not have to pay the independent contractor’s Federal Insurance Contribution Act (FICA) or Federal Unemployment Tax Act (FUTA) taxes. In addition, the employer is not required to provide employee benefits (workers’ compensation insurance, vacation pay, sick leave, health insurance, pension contributions). The disadvantages to the independent contractors include denying them the protection of workplace laws and the absence of unemployment insurance and workers’ compensation.

[3] William P. Prescott, Dental Economics, October 2017, Pennwell Publishing

The IRS is viewing the increased usage of contractors with suspicion. The IRS estimates that it loses $1.5 billion annually in income, Social Security, and unemployment tax revenue from misclassifying workers as independent contractors. The US Treasury estimated that the misclassification costs would yield $8.71 billion for the period of FY 2012 through 2021.[4]

[4] National Employment Law Project, Fact Sheet, 2015, http://www.nelp.org/publication/independent-contractor-misclassification-imposes-huge-costs-on-workers-and-federal-and-state-treasuries/

How the IRS Defines an Independent Contractor

In making determinations as to the status of a worker, the IRS focuses on the concept of control. Revenue ruling 87-41 states that: “Generally, the relationship of employer and employee exists when the person for whom the services are performed has the right to control and direct the individual who performs the services not only as to the result to be accomplished by the work, but also as to the details and means by which that result is accomplished. That is, an employee is subject to the will and control of the employer not only as to what shall be done but as to how it shall be done.”

Ruling 87-41 lists a twenty-question test that the IRS uses in determining the correct worker’s classification status (see bold print in itemized points below). Employers can use these factors in evaluating their own workforces to determine that workers are appropriately classified. The weight given to each factor will vary depending on each situation. The control test involves an analysis of three basic categories: behavioral control (is the associate subject to practice scheduling and restrictive covenants), financial control (does the employer bill the patients, set and collect fees and pay operating expenses), and relationship of the parties.

Ruling 87-41 Factors

- Is the worker subject to the employer’s instructions? A worker who is required to comply with the employer’s instructions as to when, where and how work is to be done is most likely an employee. It is only required that an employer have the right to control the worker, whether or not the control is implemented is irrelevant.

- Does the employer provide training? Any form of employer-provided training suggests an employee-employer relationship since training implies that the work needs to be performed in a particular manner. The IRS defines training in very broad terms.

- What is the degree of integration of the services into the business? If the success of the services performed by the individual is crucial to the success of the business as a whole, control over the services is presumed to exist.

- Does the worker personally render the services? Services required by the employer indicate employer control.

- Who is responsible for hiring, supervising and paying? Hiring, directing, or paying, when done by the employer, shows an employee-employer arrangement.

- Does a continuing relationship exist? Continuing work by the individual, even if not regular, points toward an employer-employee relationship.

- Does the employer set hours of work? If the employer is designating work hours, this demonstrates control over the worker.

- Is full-time work required? Utilizing a worker on a full-time basis precludes the worker from pursuing other work and is an indication of control.

- Is the person doing work on the employer’s premises? This tends to indicate control by the employer and is indicative of employment status.

- Is the work order or sequences set by the employer? Following routines or work patterns established by the employer is indicative of employee status.

- Are oral/written reports required? The requiring of regular progress reports demonstrates control.

- Is payment by the hour, week or month? Payment on a fixed periodic basis, rather than upon completion of the work, is an indicator of employee status.

- Does the employer make payment for business and/or traveling expenses? The payment of these expenses by the employer points to regulation of business activities and indicates employee status.

- Is the employer responsible for the furnishing of tools and materials? Independent contractors normally provide their own tools and materials.

- Is the worker required to make a significant investment to perform the work? The making of an investment by the worker, e.g. rental of a facility, tends to support the existence of independence.

- Does performance result in realization of profit or loss? The ability to realize either a profit or a loss in performing the work is a characteristic of an independent contractor.

- Is the individual working for more than one firm at a time? The performance of services for several customers simultaneously is typical of an independent contractor.

- Is the individual engaged in making service available to the general public? Marketing one’s services to the general public indicates independence.

- Does the employer have a unilateral right to discharge the worker? The right to discharge at will indicates an employer-employee relationship. Independent contractors typically can only be discharged for failure to meet contract requirements.

- Does the worker have a unilateral right to terminate his services? An employee may resign at will, but an independent contractor may be contractually obligated to perform.

For a more detailed description of the above factors, visit http://employment.findlaw.com/hiring-process/being-an-independent-contractor-vs-employee.html.

Other Considerations

You must file Form 1099-MISC, Miscellaneous Income, to report payments of $600 (in a calendar year) or more to persons not treated as employees (e.g. independent contractors) for services performed for your trade or business. Visit https://www.irs.gov/forms-pubs/RDA-2017-10-12-2017-Form-1096 for more information.

For more information, refer to Publication 15-A (2017), Employer’s Supplemental Tax Guide at http://www.irs.gov/publications/p15a/index.html, then click on the Independent Contractor link on the left side of the page. If you want the IRS to determine whether a specific individual is an independent contractor or an employee, file Form SS-8 (PDF), Determination of Worker Status for Purposes of Federal Employment Taxes and Income Tax Withholding at https://www.irs.gov/pub/irs-pdf/fss8.pdf.

Misclassification of Employees and the Consequences

Based on the factors in Revenue Ruling 87-41, employers should assess their current practices in regard to their ![]() treatment of subcontractors for withholding and payroll tax purposes. Keep in mind that improper classification of employees as independent contractors could expose a company to substantial liability for the payment of back taxes if the IRS were to successfully challenge the treatment. A company should also be aware that each time it files the required Form 1099-MISC for payments to an independent contractor, it is providing notice to the IRS. In addition, there is always the possibility that a disgruntled “consultant” will later allege that an employer-employee relationship existed in an attempt to hold the employer liable for withholding and payroll taxes. Accordingly, companies should be careful to document consulting arrangements in a written agreement that clearly delineates the rights and responsibilities of the parties.[5]

treatment of subcontractors for withholding and payroll tax purposes. Keep in mind that improper classification of employees as independent contractors could expose a company to substantial liability for the payment of back taxes if the IRS were to successfully challenge the treatment. A company should also be aware that each time it files the required Form 1099-MISC for payments to an independent contractor, it is providing notice to the IRS. In addition, there is always the possibility that a disgruntled “consultant” will later allege that an employer-employee relationship existed in an attempt to hold the employer liable for withholding and payroll taxes. Accordingly, companies should be careful to document consulting arrangements in a written agreement that clearly delineates the rights and responsibilities of the parties.[5]

[5] Friedman & Fuller, PC 1993

The Revenue Reconciliation Act provides for a monetary penalty for negligent disregard of the tax rules and regulations. Other employer assessments may apply such as: (1) interest on tax underpayments is currently payable to IRS at 8%, compounded daily, (2) 7.65% of the employer share of FICA tax of the worker’s pay and additional tax of 20 % of the worker’s share of FICA and Medicare taxes, (3) additional tax of 1.5 % of the worker’s Federal withholding taxes, (4) FUTA tax of 6.2% of the workers’ pay up to $7,000 per worker, (5) the bill for IRS back taxes and related penalties and interest can be a minimum of 10.68% of the employee’s back pay, (6) criminal penalties may be enforced, (7) the interest expense rate is currently 8-9% plus 3%, and (8) independent contractors may sue their employers and collect for unwithheld taxes. In addition, the IRS may notify the appropriate state governmental taxing authority and a corresponding state unemployment audit may follow.

Maybe you’ve never thought much about the difference between being an independent contractor and hiring an independent contractor. If you are accepting a job as an independent contractor or hiring one, you should know some of the key differences between being classified as a contractor and an employee.[6] The IRS consequences involved in not knowing can be significant and severe. If you have additional questions about the law, speak with an employment attorney today.

[6] Law Offices of W. Dan Mahoney, http://www.mahoneylawoffice.com

Resources

Much of the information provided was gathered from the following web sites:

http://www.morebusiness.com/running_your_business/taxtalk/indvsemp.brc

http://employment.findlaw.com/hiring-process/being-an-independent-contractor-vs-employee.html

https://www.irs.gov/forms-pubs/RDA-2017-10-12-2017-Form-1096

http://www.irs.gov/publications/p15a/index.html

https://www.irs.gov/pub/irs-pdf/fss8.pdf

The information contained in this article is general in nature and is not legal, tax or financial advice. For information regarding your particular situation, contact an attorney or a tax or financial advisor. The information in this newsletter is provided with the understanding that it does not render legal, accounting, tax or financial advice. In specific cases, clients should consult their legal, accounting, tax or financial advisor. This article is not intended to give advice or to represent our firm as being qualified to give advice in all areas of professional services. To the extent that our firm does not have the expertise required on a particular matter, we will always work closely with you to help you gain access to the resources and professional advice that you need.

Tracker Enterprises is proud of its reputation for being viewed as “external” or “part-time” CFO to our clients. For a sample of how Tracker’s unique mentoring, operational management and forecasting tools can help your business prepare for a successful financial future, complete the CONTACT US section. Feel free to forward this Tracker Tips e-newsletter/blog post to friends, family, or business acquaintances. We welcome anyone to our mailing list, so invite colleagues to send their e-mail addresses to the CONTACT US section.

Are You Ready to Meet or Exceed Your Goals?

We are here for you. Let us help you succeed in your career!

Learn how you can build and run a sustainable, scalable, profitable, and salable practice.