“My problem is reconciling my gross habits with my net income.” – Errol Flynn

Should You Do A Budget For Your Practice?

Most of us, as doctors and as the doctors’ office managers, can relate to the witty quote above by the famous playboy movie star of old, Errol Flynn (1909 – 1959). We want to be able to spend the dollars to allow our practices to function correctly, but we tend to allow our whims, not hard evidence, dictate our spending habits. The old days are gone when a doctor could “hang a shingle” and be successful in spite of himself/herself.

At one of our recent seminars, I asked 40 participants for a show of hands for those that did annual budgets; only one doctor responded that he did. Do you do a budget? Most large companies do budgets once per year, usually near the end of the year previous to the year of the budget or immediately after seeing their financials for the year that just ended. If you have not yet done a budget for this year, it is time to start to consider it.

What is a Budget?

By definition, a “budget” is an itemized summary of probable expenditures and income for a given period of time.[1] In other words, budgeting is the periodic (e.g., annual) review of past financial information with the purpose of predicting future financial conditions.![]()

Budgets are good for planning for the future by looking at the past. For example, what did you do last year and how might those financial experiences apply to the next year? How much will the past years’ experiences apply or not apply to the new year? What new expenses or new sources of revenue may occur?

Why Should You Prepare a Budget?

In order for your business to achieve maximum success, dependable budgets are necessary for sound operational management and planning. Budgets help to define and predict production and revenue information and dollar requirements for areas such as labor, clerical and clinical supplies, laboratory costs, rent or mortgage expenses, capital expenses such as equipment and maintenance, communications, administration, marketing, the development of new products and services and/or changes proposed for existing products or services, leasehold improvements and debt service.

Your financial reports (e.g., Income or P&L Statements, Balance Sheets, General Ledgers, Cash Flow Statements, etc.), usually prepared by your accountant or bookkeeper, are designed to demonstrate how your business has performed in the past so that you can use this information to guide you in assembling your budget. These statements allow you to evaluate the past performance of your company, and they also give you some of the information you will need when estimating the future prospects for your practice.

Some important questions you might want to consider include:

- Did your business make a profit, suffer a loss, how much and why?

- What is the cash flow effect from the profit or loss for the period?

- What liabilities (e.g., loans, leases, credit cards, etc.) do you have, and how do you plan to pay them in the upcoming year?

- How do your assets stack up against your liabilities?

- Should the business reinvest all of its profit or distribute some of the profit to the owners?

- Does your business have enough capital for future growth?

Once you have answered these questions by evaluating historically based financial reports, you can redirect the answers toward future planning and preparation of your budget.

Preparing a Budget

Take the first step to knowing exactly where your company is going financially; prepare or have someone prepare a budget for your practice.

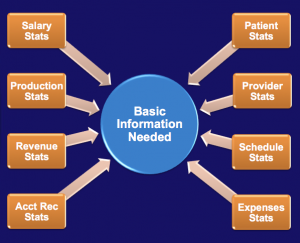

The basics involved in preparing a budget include the evaluation of your past production, revenue and expenses and then,![]() applying that information to several mathematical formulas that can estimate future performance.

applying that information to several mathematical formulas that can estimate future performance.

Production is what your practice charges out for the procedures you and your other producers/providers (e.g., associate doctors, PAs, physical therapists, hygienists, etc.) do. You should start by estimating what each provider’s charges might be in the new year. A good way to do this is to take the average daily production per provider for the most recently completed year. Once you know that, and you know the number of days each provider will work in the coming year, you can estimate your overall production for the year being budgeted.

Revenue consists of the actual dollars collected for the production your practice does. Remember, revenue, not production, pays the bills. Ideally, revenue should relate directly to your production estimates, but in some practices, these values may not be the same. Examples of reasons why these values may differ are:

- Does your practice accept alternative insurance (e.g., PPOs, HMOs, in-office discounts, etc.)? If so, you will have to adjust the revenue anticipated based on the percentage discounts you might anticipate from these alternative insurance plans. (Remember, you always want to initially charge out your usual and customary full fee for all procedures and then, after the revenue is received in full from insurance, adjust the amount based on the actual revenue realized.)

- Is your accounts receivables program in order? If you have higher than ideal accounts receivables, especially in the over 90-day category, revenue will never compare well with production.

Expenses include the everyday costs of running your practice, your compensation as an owner, liability expenses, debt service, etc. There are two basic approaches to budget your expenses from year to year:

- The first way is to assume a percentage increase for each fixed expense category (e.g., rent), each variable expense category (e.g., supplies), and each revenue category. By simply adding a percentage to last year’s numbers, you can arrive at next year’s budget easily and rapidly. The calculations are simple and involve very little time. Although this method can result in a quick estimate, it may not be very accurate.

- If you want to really test how well you’ve been managing your expenses, however, you might also want to consider more in-depth evaluation. Zero-based budgeting assumes that each new budget year’s expenses start at zero. For example, with supplies, you would assume, based on past experience and estimated future needs, how much will be used in the next year. For example, you could get bids from different suppliers to determine if you’ve been getting the best deals in the past. With this information, you may find that some of the expenses in next year’s budget may actually go down, or at least, stay the same if you do business with different, more competitive vendors.

Once you have determined your production, revenue and expenses, it becomes a simple matter of mathematics. ![]() In other words, subtract the anticipated expenses from the revenue to determine your profitability. If the outcome is negative, you need to consider adjustments before you get too far in the hole as the year progresses. Sounds simple, but …

In other words, subtract the anticipated expenses from the revenue to determine your profitability. If the outcome is negative, you need to consider adjustments before you get too far in the hole as the year progresses. Sounds simple, but …

If you would like some help …

The above description of preparing a budget may seem simple. The mathematics involved, however, to prepare a good budget can be overwhelming and time consuming for the doctor/owner whose time is best spent treating patients. In addition, once you have the results, what can you do to improve proposed outcomes that the budget may be predicting? Another frequently asked concern is whether you should try to cut expenses or increase production/revenue?

And, if you do decide to do any of these scenarios, how do you estimate possible outcomes?

Tracker Enterprises, Inc. is proud of its reputation for being viewed as “external” or “part-time” CFOs to our doctor clients. Understand that we do budgets and what ifs for our clients on a routine basis, and we have proprietary models prepared to help prepare accurate templates quickly. If you have budget questions or would like help in preparing your budget for the next year, send an email me at: pjp@trackerenterprises.com.

Feel free to forward this Tracker Tips e-newsletter to friends, family, or business acquaintances. We welcome anyone to our mailing list; so invite colleagues to send their e-mail addresses to pjp@trackerenterprises.com.

The information contained in this article is general in nature and is not legal, tax or financial advice. For information regarding your particular situation, contact an attorney or a tax or financial advisor. The information in this newsletter is provided with the understanding that it does not render legal, accounting, tax or financial advice. In specific cases, clients should consult their legal, accounting, tax or financial advisor. This article is not intended to give advice or to represent our firm as being qualified to give advice in all areas of professional services. To the extent that our firm does not have the expertise required on a particular matter, we will always work closely with you to help you gain access to the resources and professional advice that you need.

Are You Ready to Meet or Exceed Your Goals?

We are here for you. Let us help you succeed in your career!

Learn how you can build and run a sustainable, scalable, profitable, and salable practice.